Gaap Uses Which Principle to Determine an Assets Cost

It is also referred to as the historic cost principle. GAAP has four basic principles.

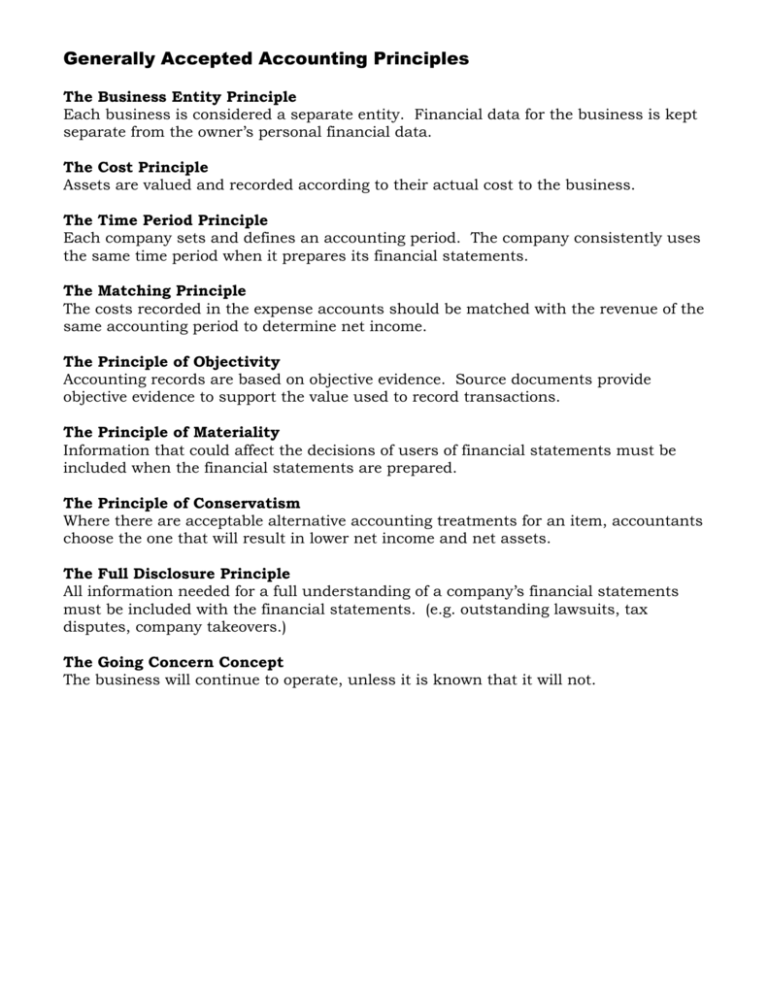

Generally Accepted Accounting Principles

Whether a 50 printer you purchase is an expense or an asset is a matter of debate.

. Declining Balance Method. GAAP allows companies to capitalize costs if theyre increasing the value or extending the useful life of the asset. The LCM rule simply states that when you calculate the value of inventory you should price lower than either its purchase price or current market value.

The historical cost principle is a basic accounting principle under US. This original cost is maintained throughout the assets life. This real gap in GAAP is one reason business valuation methods such as the asset accumulation technique exist.

Under generally accepted accounting principles GAAP in the United States the historical cost principle accounts for the assets on a companys balance sheet based on the amount of capital spent to buy them. It is generally used in three different contexts in business which include the following. Under GAAP companies can capitalize land and equipment improvements as long as they arent part of normal maintenance.

Two laws the Securities Act of 1933 and the Securities Exchange Act of. Inventory valuation is usually a conservative estimate in GAAP and uses a rule called least-of-cost-or-market or LCM. Many users of financial information support the use of revaluation.

The difference is the business value. The cost principle requires that a business records its assets at the cash amount it was acquired for. What Are the Four Principles of GAAP.

The principle is widely used to record transactions partially because it is easiest to use the original purchase price as objective and verifiable evidence of value. This method is based on a companys past transactions and is conservative easy to calculate and reliable. In order to simplify the decision GAAP states that purchases must have a useful life of more than one year to be capitalized as assets to simplify the decision.

Set up Costs Can be Capitalized Too. Generally Accepted Accounting Principles GAAP. The concept is in conjunction with the cost principle which emphasizes that assets equity investments and liabilities should be recorded at their respective acquisition costs Acquisition Cost Acquisition cost is the cost of purchasing an asset.

To determine the business value you compile the list of all business assets tangible and intangible costed or internally developed along with all the liabilities. Cost Accumulated Depreciation Declining Balance Rate OR Book Value Declining Balance Rate Rate Double the straight-line method rate. The cost principle requires that the actual cost of assets be recorded instead of recording the cost based on market values or adjusting for inflation.

GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission SEC. Identify assets and liabilities. The business is considered a separate entity so the activities of a business must be kept separate from the financial activities of.

International accounting standards are more convention based relying more on current practices than on precise rules of how companies must report transactions. Generally accepted accounting principles or GAAP recognize differing expectations of the useful of the different types of assets. The cost principle also known as the historical cost principle states that assets should be recorded at their original cost rather than their current market value.

Assets liabilities accounts payable and accounts receivable are all on the balance sheet. A variation on the concept is to allow the recorded cost of an asset to be. Assume that the company that you work for was conducting an asset impairment test.

Does GAAP use fair value accounting. Under generally accepted accounting principles GAAP in the United States the historical cost principle accounts for the assets on a companys balance sheet based on the amount of capital spent to buy them. Valuing assets at historical cost prevents overstating an assets value when asset appreciation may be the result of volatile market conditions.

GAAP is a common set of generally accepted accounting principles standards and procedures that public companies in the US. Generally Accepted Accounting Principles GAAP use historical cost to value plant assets whereas international standards allow revaluation. Details the companys total revenues expenses cost of sales and other income.

GAAP principles determine the rules for how a company can issue stock to raise money. Investors can look to the balance sheet to determine the companys current liquidity. Must follow when they.

A business expects these items to contribute to company profit for years the principle of matching income and expense requires spread the cost over the useful lifetime of the asset. Accountants use generally accepted accounting principles GAAP to guide them in recording and reporting financial information. The Financial Accounting Standards Board FASB uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices.

1 This method is based on a companys past transactions and is conservative easy to calculate and reliable. A sellers GAAP balance sheet may exclude certain intangible assets and contingencies such as internally developed brands patents customer lists environmental claims and pending lawsuits. Details the overall value of the company.

The best way to understand the GAAP requirements is to look at the ten principles of accounting. Generally accepted accounting principles or GAAP are standards that encompass the details complexities and legalities of business and corporate accounting. At no point in time should an asset be recorded at.

Overlooking identifiable assets and liabilities often results in inaccurate reporting of goodwill. The cost principle requires one to initially record an asset liability or equity investment at its original acquisition cost. 100useful life x 2 OR 200 useful life Residual Value is not used in the calculation of annual depreciation until the last year.

International Financial Reporting Standards Ifrs Accounting Books Accounting Accounting And Finance

Gaap What Are Generally Accepted Accounting Principles 1 800accountant

No comments for "Gaap Uses Which Principle to Determine an Assets Cost"

Post a Comment